In an era where financial independence is increasingly sought after, the concept of passive income has garnered immense attention. Active income requires constant effort and time. Passive income streams offer the promise of earning money with minimal ongoing work. Whether you aspire to supplement your current earnings, build a nest egg for retirement, or achieve complete financial freedom. Mastering the art of generating passive income is essential. In this comprehensive guide, we delve into various strategies and techniques to help you boost your passive income. You can pave the way towards a more secure financial future.

Understanding Passive Income

Before diving into strategies to increase passive income, it’s crucial to grasp the fundamental concept behind it. Passive income refers to earnings derived from sources that require little to no effort to maintain. These income streams continue to generate revenue even when you’re not actively working on them. Examples of passive income sources include rental properties, dividends from investments, interest from savings accounts, royalties from creative works, and income generated from automated online businesses.

Assessing Your Financial Goals

The journey towards increasing passive income begins with a clear understanding of your financial goals. Take the time to assess your current financial situation. Identify your short-term and long-term objectives. Determine how much earnings you need to achieve them. Whether your goal is to achieve financial independence, pay off debt, or build wealth. Having a concrete plan in place will guide your efforts and help you stay focused.

Diversifying Your Income Streams

One of the key principles of building wealth and achieving financial stability is diversification. Relying solely on one source of passive income can leave you vulnerable to economic downturns or changes in market conditions. To mitigate risk and maximize your earning potential, diversify your income streams across various asset classes and investment vehicles. Consider allocating your resources to real estate investments, dividend-paying stocks, peer-to-peer lending platforms, and online businesses to create a robust and resilient passive revenue portfolio.

Investing in Real Estate

Real estate has long been regarded as one of the most reliable and lucrative avenues for generating passive revenue. Whether through rental properties, real estate investment trusts (REITs), or real estate crowdfunding platforms, investing in real estate offers the potential for steady cash flow and capital appreciation over time. Conduct thorough research, analyze market trends, and consider factors such as location, property type, and rental demand to make informed investment decisions.

Building a Dividend Portfolio

Dividend investing is another popular strategy for generating passive revenue, particularly for those seeking regular cash flow and long-term growth. By investing in dividend-paying stocks, you can earn a steady stream of income from quarterly or annual dividend distributions. Focus on companies with a history of consistent dividend payments, strong financial fundamentals, and sustainable business models. Reinvesting dividends can also accelerate the growth of your portfolio through the power of compounding.

Leveraging the Power of Compound Interest

Compound interest is often hailed as the eighth wonder of the world, and for good reason. You can reinvest your earnings and allow them to generate additional returns over time. Besides you can harness the power of compounding to exponentially grow your wealth. Whether through high-yield savings accounts, certificates of deposit (CDs), or dividend reinvestment plans (DRIPs), prioritize investments that offer compound interest to maximize your earnings potential.

Monetizing Your Skills and Expertise for Passive Income

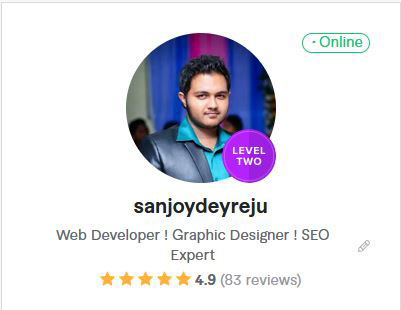

In today’s digital age, the internet has opened up a wealth of opportunities for monetizing your skills and expertise. Whether you’re a talented writer, graphic designer, programmer, or educator, there are countless platforms and marketplaces where you can sell your products or services online. Create digital products such as e-books, online courses, or software applications, and leverage platforms like Amazon, Udemy, or Etsy to reach a global audience and generate passive revenue while you sleep.

Creating Passive Income Streams with Affiliate Marketing

Affiliate marketing offers another lucrative avenue for generating passive income online. By promoting products or services through affiliate links, you can earn commissions on sales generated through your referral traffic. Identify products or services that align with your interests and target audience, and leverage content marketing strategies such as blogging, social media marketing, or email newsletters to drive traffic and conversions. As your audience grows, so too will your passive income from affiliate marketing.

Automating Your Business Processes for Passive Income

Automation is the key to unlocking true passive income potential. By leveraging technology and automation tools, you can streamline your business processes, reduce manual work. Also you can free up more time to focus on income-generating activities. Whether it’s automating email marketing campaigns, implementing chatbots for customer support, or using robo-advisors for investment management, embrace automation to scale your passive income streams efficiently and effectively.

Monitoring and Adjusting Your Strategies

Passive income has the potential to provide financial freedom. It’s essential to monitor your income streams regularly and make adjustments as needed. Stay informed about changes in market conditions, reassess your investment portfolio periodically, and explore new opportunities for diversification. By remaining proactive and adaptive, you can optimize your earning streams. Also you can continue to build wealth over the long term.

Conclusion

Increasing passive income is not a one-size-fits-all endeavor. But rather a personalized journey tailored to your unique financial goals and circumstances. By diversifying your income streams, investing strategically, harnessing the power of compounding, and leveraging digital platforms and automation tools, you can create multiple sources of passive income that work for you around the clock. With patience, perseverance, and a willingness to learn, you can unlock the doors to financial freedom. Also you can build a more secure and prosperous future for yourself and your loved ones.